Licence Application Process

Licence Application Process

Where to Apply | Documents Required | Validity of the Licence | Prescribed Fee | Processing Time | Notification of Outcome | Need Help?

Where to Apply

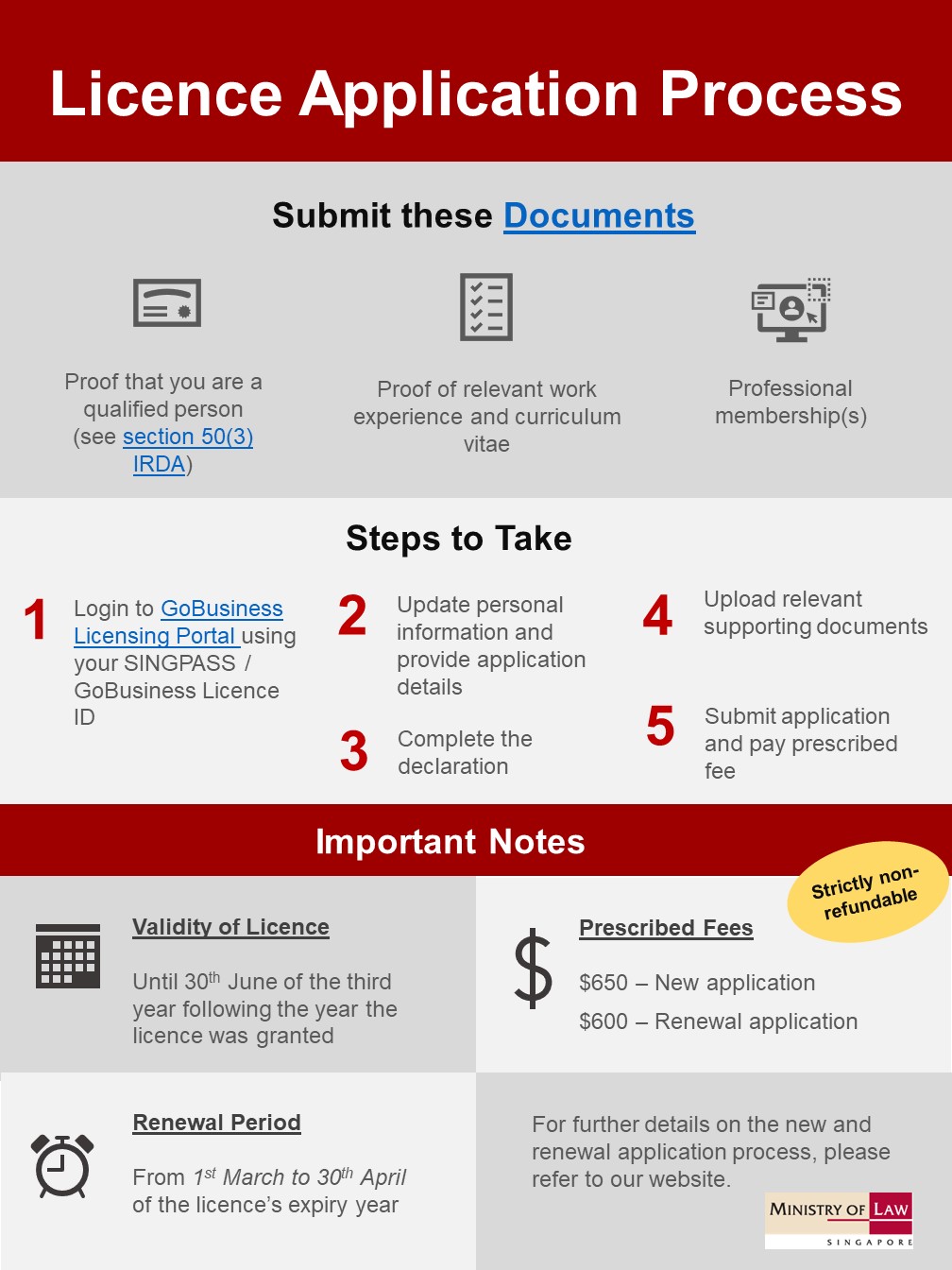

Please submit your application through the Government’s GoBusiness Licensing Platform using either your SINGPASS (For Singaporeans / Singapore Permanent Residents (“SPR”)) or GoBusiness Licence ID (For non-Singaporean / SPR).

For non-Singaporean / SPR without Singpass, please click here to register a new user account before you submit your application.

Documents Required

Please attach a copy of the following documents when submitting your licence application online:

a) Evidence that you are a qualified person within the meaning of section 50(3) of the Insolvency, Restructuring and Dissolution Act 2018 (“IRDA”):

- For Solicitors – Valid Practising Certificate issued by the Supreme Court

- For Public Accountants – Valid Certificate of Registration issued by the Accounting and Corporate Regulatory Authority (“ACRA”)

- For Chartered Accountants – Recent Certificate of Good Standing issued by the Institute of Singapore Chartered Accountants (“ISCA”)

b) Professional Membership(s) in any local or foreign professional bodies relating to your qualification, which may include:

- The Law Society of Singapore

- ISCA

c) Proof of relevant work experience and curriculum vitae (excluding previous appointments and work experience in members’ voluntary winding up or schemes of arrangement) to be eligible for the grant or renewal of the licence. The supporting documents will include (but are not limited to):

| Requirement | Supporting Documents |

| i. Applicant has acted as an insolvency practitioner in relation to a corporation or an individual under the IRDA or under any corresponding previous law; |

Recent copies of orders of court, resolutions passed by members and / or creditors of the company evidencing Applicant’s appointment and the capacity in which he was appointed. |

| ii. Applicant has assisted another person in that person acting as an insolvency practitioner in relation to a corporation or an individual, under the IRDA or under any corresponding previous law, for a minimum of 3 continuous years, of which 2 years must be at a supervisory level; or | Written confirmation from the person acting as an insolvency practitioner and whom has directly supervised the work of the Applicant, or work testimonial issued by the Applicant’s employer confirming the following: • Applicant’s job position; • Applicant’s role / involvement in the firm / organisation and; • The number of years of relevant experience in insolvency work attained with the firm / organisation. Details of each case that the Applicant has undertaken including: • Name of company / bankrupt; • Case reference no. (if any); • Role performed / undertaken by Applicant; and • If at a supervisory level, the duration for which the role was performed / undertaken. |

| iii. Applicant has acted as a solicitor for a creditor or a debtor in relation to a bankruptcy application, or for a creditor or a bankrupt in relation to the administration of any bankruptcy, under the IRDA or under any corresponding previous law within the last 3 years before the date of the application for a grant of an insolvency practitioner’s licence. |

• Where the Applicant has acted as a solicitor for a creditor or debtor in a bankruptcy application, please provide the case reference no. of the cases in the last 3 years. • Where the Applicant has acted as a solicitor for a creditor or a bankrupt in relation to the administration of a bankruptcy in the last 3 years, please set out the brief details of the bankruptcy case(s) and the Applicant's role. |

d) For purposes of satisfying the requirements under Regulation 5(3A) of the Insolvency, Restructuring and Dissolution (Insolvency Practitioners) (Amendment) Regulations 2023 (“IRD (IP) Regs 2023”), the supporting documents will include but are not limited to:

| Requirement | Supporting Documents |

| i. Applicant holds and has held the equivalent of an insolvency practitioner’s licence in a foreign jurisdiction for a minimum of 3 continuous years; and ii. Applicant has acted as the equivalent of a licensed insolvency practitioner in relation to a corporation under any foreign law, in respect of proceedings relating to corporate insolvency, restructuring or dissolution that are international and commercial in nature; or where relief was sought from a court of a foreign jurisdiction under the Model Law as given effect in that jurisdiction. |

• Curriculum vitae; • Documents evidencing that Applicant holds a valid insolvency practitioner’s licence (or its equivalent accreditation or registration) in a foreign jurisdiction, and has held it for at least 3 continuous years under Regulation 5(3A)(b)(i) of the IRD (IP) Regs 2023; and • Documents evidencing Applicant’s appointment as a licensed insolvency practitioner (or its equivalent) as set out under Regulation 5(3A)(b)(ii) of the IRD (IP) Regs 2023. |

Validity of the Licence

A licence that is issued for the first time, i.e. a new insolvency practitioner’s licence will remain valid until 30 June of the third year following the year in which the licence was granted. For example, if a licence is granted on 1 September 2020, it will expire on 30 June 2023 (i.e. 2020 + 3 years).

For information relating to renewal of licence, please refer to “Renewal of Licence”.

Prescribed Fee

An application fee of $650.00 is payable for any new application for insolvency practitioner’s licence.

Payments can only be made through the GoBusiness Licensing Portal using the following electronic payment modes:

- PayPal;

- VISA;

- Mastercard;

- American Express; or

- Discover.

Please note that the application fee is strictly non-refundable, regardless of the outcome of your licence application (e.g. withdrawal by applicant, rejection of application).

Processing Time

Depending on the complexity of the application, we may take up to 2 to 3 weeks to process your licence application. Please note that the processing time may take longer if the documents submitted in support of the application are incomplete or not in order, and / or further clarification is required based on the information submitted.

Notification of Outcome

You will be notified of the outcome of your licence application via post and email. If your application is successful, you will also receive a copy of the insolvency practitioner’s licence. The update on the status of your application will also be available on the GoBusiness Licensing Portal.

Need Help?

If you encounter difficulties or are uncertain of how a licence application should be submitted on the GoBusiness Licensing Portal, please refer to our Licence Application Guide for insolvency practitioners for more information.